Events

-

“VC and PE: From Law School to the Deal Table”

Thursday, March 12, 12:30-1:30 at the Alumni Reception Center

Join us for a CBL Lunch Speaker event featuring Mike Guo, Former General Counsel at TPG Growth, and Judy Yuan, COO and General Counsel at Sentinel Global, moderated by Professor Evan Epstein. This conversation will explore the role of counsel in venture capital and private equity transactions, including deal structuring, governance, risk management,

Read more » -

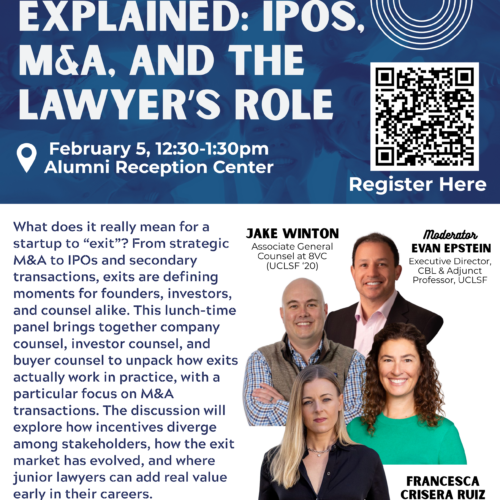

“Startup Exits Explained: IPOs, M&A, and the Lawyer’s Role”

February 5, 2026 12:30-1:30 at the Alumni Reception Center

What does it really mean for a startup to “exit”? From strategic M&A to IPOs and secondary transactions, exits are defining moments for founders, investors, and counsel alike. This lunch-time panel brings together company counsel, investor counsel, and buyer counsel to unpack how exits actually work in practice, with a particular focus on M&A transactions.

Read more » -

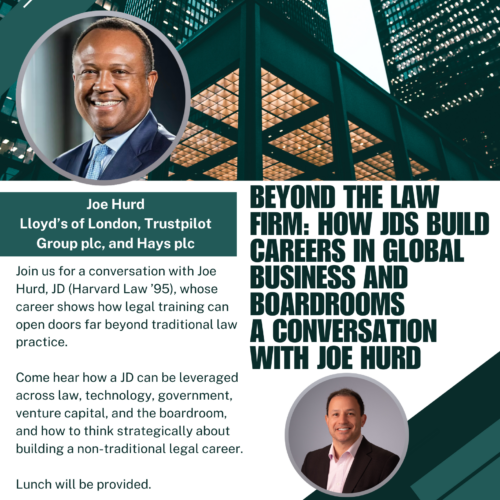

Beyond the Law Firm: How JDs Build Careers in Global Business and Boardrooms, a Conversation with Joe Hurd

January 22, 2026 12:30-1:30pm

Join us for a conversation with Joe Hurd, JD (Harvard Law ’95), whose career shows how legal training can open doors far beyond traditional law practice. Joe began his career practicing corporate and securities law at Linklaters in London, qualifying as a solicitor in England and Wales. He then moved into the technology and startup world,

Read more » -

Business Law Track for 1Ls & The CBL Scholars Program

October 30 @ 12:30 pm – 1:30 pm

Register in this link: https://www.uclawsf.edu/event/business-law-track-for-1ls-and-the-cbl-scholars-program/

Read more » -

4th VC-Backed Board Academy (VCBA)

At Cooley NYC on October 28, 2025

The VC-Backed Board Academy (VCBA) is a one-day executive education program specifically designed for board members of private venture-backed companies.

The program focuses on the unique corporate governance challenges faced by startup boards, including some of the following topics:

Fiduciary Duties and Navigating Conflicts of Interest

The Evolving VC Funding Landscape: Key Insights for Boards

Managing Risk: AI,

Read more » -

Crypto, Compliance & Governance: A Conversation with Candace Kelly

CBL Lunch Speaker Series: September 25, 2025, @ 12:30pm | Alumni Reception Center

You can register in this link: https://uchastings.co1.qualtrics.com/jfe/form/SV_7arolBkQRSqJIWi

Read more » -

CBL Kick Off & Happy Hour

September 3, 2025 @ 4:00pm | Skydeck

Register in this link: https://www.uclawsf.edu/event/cbl-kick-off-happy-hour/

Read more » -

3rd VC-Backed Board Academy (VCBA)

At Cooley SF on May 14, 2025

The VC-Backed Board Academy (VCBA) is a one-day executive education program specifically designed for board members of private venture-backed companies.

The program focuses on the unique corporate governance challenges faced by startup boards, including some of the following topics:

Fiduciary Duties and Navigating Conflicts of Interest

The Evolving VC Funding Landscape: Key Insights for Boards

Managing Risk: AI,

Read more » -

Venture Fund Representation: Insights from Leading Counsel

CBL Lunch Speaker Series: Thu Feb 27, 2025 @ 12:30-1:30pm

Register IN THIS LINK!

Read more » -

VC-Backed Board Academy (VCBA) Prepares Startup Directors to Drive Growth and Innovation

Nasdaq’s MarketSite in New York City’s Times Square buzzed with startup directors and industry leaders for the biannual Venture Capital-Backed Board Academy on Oct. 29, 2024, organized by UC Law SF’s Center for Business Law and sponsored by Cooley, Nasdaq and Woodruff Sawyer.

Full article: https://www.uclawsf.edu/2024/11/18/vcba-nyc/